All Categories

Featured

Think About Utilizing the DIME formula: cent means Financial obligation, Revenue, Home Mortgage, and Education. Complete your financial debts, home loan, and college costs, plus your salary for the variety of years your household requires defense (e.g., up until the children run out your home), which's your coverage need. Some economic specialists compute the amount you need utilizing the Human Life Worth viewpoint, which is your lifetime earnings prospective what you're gaining now, and what you expect to make in the future.

One way to do that is to try to find firms with strong Financial toughness scores. iul vs term life insurance. 8A business that underwrites its own plans: Some firms can offer policies from one more insurance firm, and this can add an added layer if you desire to change your plan or later on when your household needs a payment

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

Some firms offer this on a year-to-year basis and while you can expect your rates to increase considerably, it may be worth it for your survivors. One more way to compare insurer is by checking out on-line customer evaluations. While these aren't likely to inform you a lot about a business's monetary stability, it can inform you exactly how easy they are to work with, and whether cases servicing is an issue.

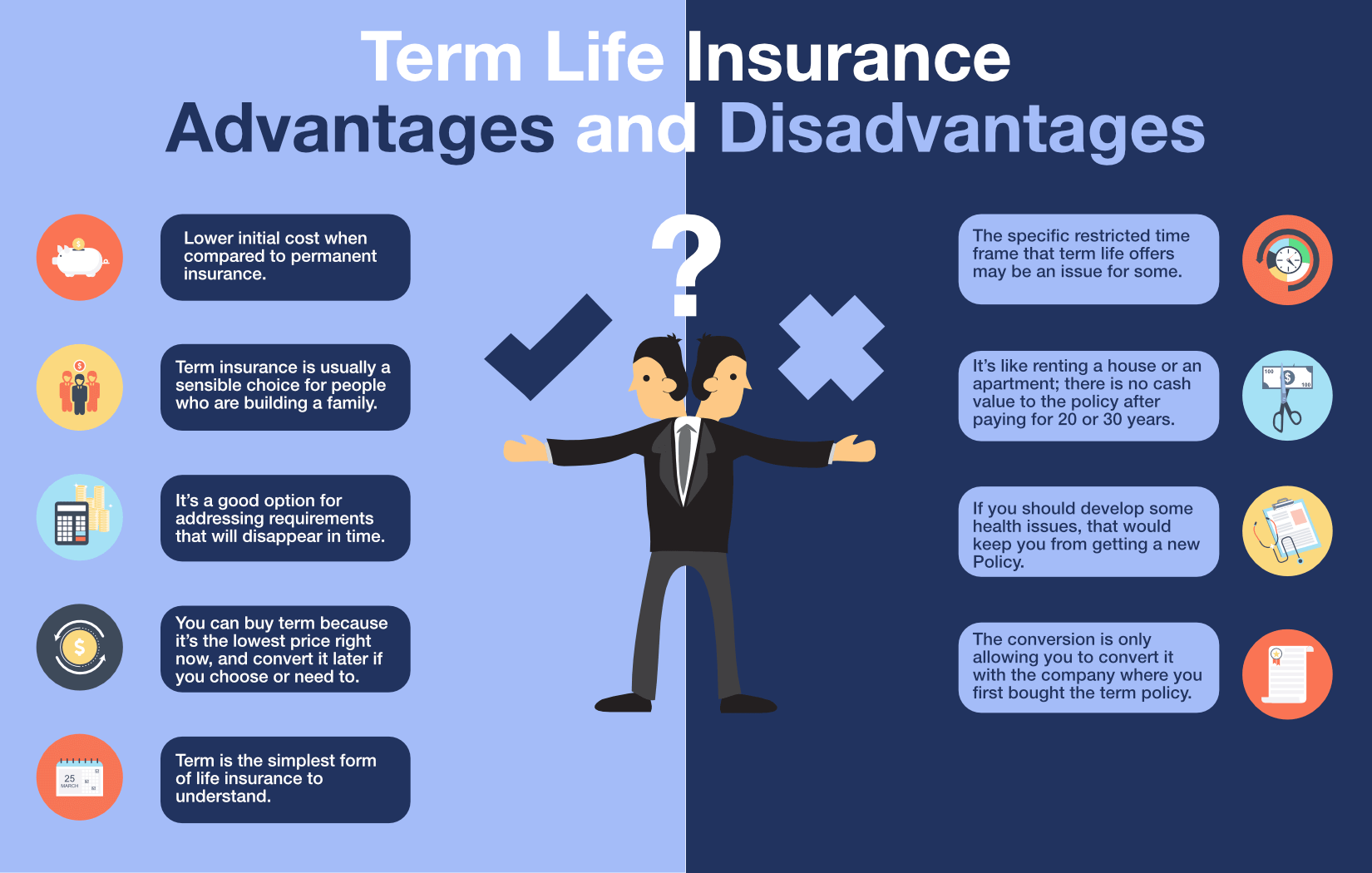

When you're younger, term life insurance policy can be an easy method to protect your enjoyed ones. However as life adjustments your monetary priorities can also, so you may wish to have whole life insurance policy for its life time protection and additional benefits that you can use while you're living. That's where a term conversion comes in - dependent term life insurance.

Approval is assured no matter your health and wellness. The premiums won't enhance once they're established, however they will increase with age, so it's an excellent idea to lock them in early. Learn even more about how a term conversion functions.

1Term life insurance policy provides momentary security for a critical period of time and is usually more economical than irreversible life insurance policy. extending term life insurance. 2Term conversion guidelines and constraints, such as timing, may apply; for instance, there may be a ten-year conversion advantage for some products and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance Acquisition Option in New York. There is a price to exercise this biker. Not all getting involved policy proprietors are qualified for rewards.

Latest Posts

45 Term Life Advanced Insurance

Term Life Insurance For Hiv Positive

Term Life Insurance For Police Officers